Sydney is a beautiful city and is the capital of New South Wales. It is one of the largest cities in Australia. Sydney has high living expenses.

Table of Contents

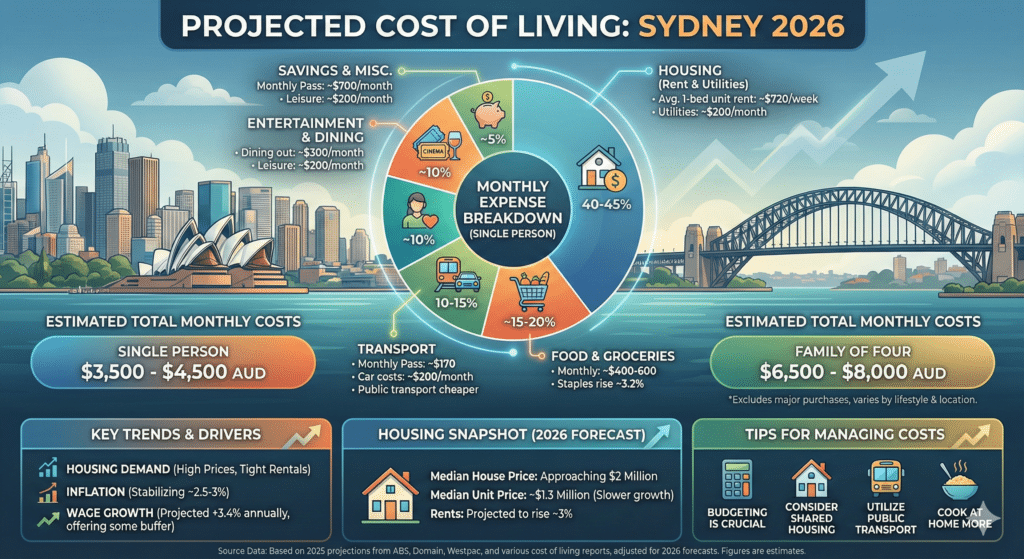

ToggleThe average monthly cost of living in Sydney without rent is around 1800 AUD, while rent in Sydney ranges from AUD 2400 to AUD 3400 per month.

The living expenses in Sydney can vary according to a person’s living standards and preferences.

Sydney has long been known as one of Australia’s most vibrant and most expensive cities. As we look toward 2026, rising inflation, strong demand for housing and global economic shifts mean that living costs are expected to remain high. Whether you’re a student, a young professional, an expat or a family planning to relocate, understanding what it might cost to live in Sydney in 2026 is crucial. This article breaks down key expense categories (rent, food, utilities, transport, and lifestyle) and offers estimates, helping you assess whether Sydney fits your budget and lifestyle plans.

Snapshot: What to Expect in 2026

Compared to many other Australian cities, Sydney remains at the top in cost-of-living rankings. As of 2025, it had a high overall cost-of-living index.

For a single person living modestly (not counting rent), typical monthly expenses — food, utilities, transport, etc. — are often in the range of AUD 1,500–2,000 (before rent).

Rent and housing remain the largest cost pressure, and recent trends suggest that housing — both rentals and purchase prices — may continue to rise.

Given these, in 2026, you should expect to budget carefully, especially for housing.

Housing & Rent in 2026

Rent & Rental Market

In 2025 data, a one-bedroom apartment in city-centre Sydney typically costs in the ballpark of AUD 1,800–2,700/month, averaging around AUD 2,150. Outside the city centre, one-bedroom rentals tend to be more affordable, with rents averaging roughly AUD 1,460/month. For larger accommodations (e.g. 3-bedroom apartments), city-centre rents are considerably higher.

What this means for 2026:

Expect rents to be higher, given ongoing demand and documented property-price increases. Unless you move to outer suburbs or shared accommodations, rent will likely remain a major chunk of your budget.

Buying Property

Pre-2026 reports cite that median property values in Sydney remain high, putting pressure on affordability. For those looking to buy, house/apartment prices are expected to stay steep, meaning renting may still be more realistic for many.

Tradeoffs: Suburbs vs. City-centre

Living farther from the central business district, in outer suburbs, tends to reduce rent significantly — at the cost of longer commutes. Many newcomers opt for suburbs or shared rentals to balance affordability vs convenience.

Utilities, Internet & Household Costs

For a typical apartment (~85 m²), monthly utilities (electricity, heating/cooling, water, garbage) in 2025-style data ranged around AUD 250–300.

Internet (broadband) typically adds another AUD 70–90/month.

Utility costs can fluctuate depending on usage (especially in hot or cold months) and energy prices, which over time may increase.

Thus, in 2026, budgeting around AUD 300–350/month for utilities + internet seems reasonable for a modest apartment, with higher amounts if energy use is heavy or for larger households.

Food, Groceries & Dining

Grocery costs for an average resident (single or small household) tend to be higher than in small Australian cities. Basic groceries — vegetables, staples, etc. — are more expensive due to the overall city cost structure.

- Many estimates show monthly grocery + basic food costs for a single person in Sydney around AUD 400–700.

- Eating out, dining at cafés or restaurants, adds noticeable costs. Leisure and dining expenses tend to be more expensive than in smaller cities.

- Therefore, in 2026, budget around AUD 500–800/month for groceries + occasional dining out, depending on your lifestyle and dietary habits.

Transport & Commuting

Sydney has a robust public transport network (trains, buses, ferries). A monthly public-transport pass costs roughly AUD 200–220 (per 2025 data).

- Single ride fares vary by distance, but using public transport regularly tends to be more cost-efficient than owning and maintaining a car in the city.

- If you choose to own a car, fuel, parking, and insurance will add significantly to your monthly costs.

- In 2026, if you rely on public transport and avoid car ownership, transport expenses are likely to be manageable at ~AUD 200–250/month.

Lifestyle, Entertainment & Miscellaneous Costs

For modest lifestyle choices, non-essential expenses — gym memberships, outings, occasional dining out or entertainment — add up considerably. Typical gym membership might cost AUD 70–100/month; entertainment (movies, events, dining out) adds more.

Dining out, nightlife, events, and weekend outings since Sydney is a major global city tend to be more expensive than in regional areas. A reasonable “buffer” for lifestyle and miscellaneous spending might be AUD 200–400/month for a single person; for couples or families, this grows accordingly.

Sample Monthly Budgets for 2026

Based on aggregated data and likely modest inflation increases, here are rough monthly budget scenarios:

|

Household Type |

Rent (modest) | Utilities & Internet | Food & Groceries | Transport | Lifestyle & Misc |

Estimated Total |

| Single person (modest city life) | AUD 1,800 | AUD 300 | AUD 500 | AUD 200 | AUD 250 | ~ AUD 3,050 |

| Single person (suburb/share) | AUD 1,400 | AUD 300 | AUD 500 | AUD 200 | AUD 250 | ~ AUD 2,650 |

| Couple, 1-bedroom (modest) | AUD 2,200 | AUD 350 | AUD 800 | AUD 300 | AUD 400 | ~ AUD 4,050 |

| Small family (2 adults + 1 child, 2-bed/3-bed apt) | AUD 2,800–3,500 | AUD 400 | AUD 1,200 | AUD 400 | AUD 500+ | ~ AUD 5,800–6,500 |

What Might Change by 2026 — Key Factors to Watch

Housing Market Pressure & Inflation — Recent data shows rising house prices, which tend to push up rents too.

Utilities Cost Fluctuations — Energy price shifts and increasing demand may drive utility bills up; this will affect monthly living costs.

Demand for Affordable Housing & Suburbs — As central Sydney stays expensive, many may prefer outer suburbs or shared housing, affecting commute time, transport costs, and lifestyle.

Exchange Rate & Global Inflation — For migrants or international students, changes in AUD exchange rates and global inflation could alter real affordability significantly.

Lifestyle Expectations — People’s spending habits (e.g. eating out, entertainment, private transport) heavily influence monthly budgets.

Tips to Manage & Reduce Costs in Sydney

- Consider outer suburbs or shared housing to bring down rent.

- Use public transport instead of owning a car as it saves fuel, parking and maintenance costs.

- Cook at home and plan groceries to limit frequent dining out.

- Monitor utility usage for energy-efficient habits/appliances that can reduce monthly bills.

- Budget realistically based on lifestyle with a plan for “must-have” vs “nice-to-have” expenses.

- Research suburbs carefully — proximity to transport, workplaces and amenities matters when balancing cost vs convenience.

Is Sydney Worth It — What to Keep in Mind?

Living in Sydney in 2026 offers a cosmopolitan lifestyle, vibrant city life, top-class amenities, great job opportunities and cultural diversity. But that comes at a cost of high rent, overall expensive daily expenses, and a narrow balance between comfort and budget constraint.

For singles and couples willing to live modestly or share accommodation, it is possible to live reasonably well with a budget of AUD 2,500–4,000/month (depending on location and lifestyle). Families or those seeking a more comfortable lifestyle should budget more often upwards of AUD 5,000–6,000/ month or more, especially if children, schooling or larger housing are involved.

If you’re flexible about suburbs, commute, and lifestyle, Sydney remains viable. But it’s critical to plan carefully, budget tightly, and be aware of potential cost pressures before relocating.

FAQs on Cost of Living in Sydney

1. How expensive is it to live in Sydney in 2026?

Sydney is one of Australia’s most expensive cities. Monthly living costs for a single person (excluding rent) may range from AUD 1,500–2,000, while a modest apartment in the city centre could cost AUD 1,800–2,700/month. For a family of four, total monthly expenses can reach AUD 5,800–6,500 depending on lifestyle.

2. What is the average rent in Sydney in 2026?

City centre one-bedroom apartment: ~AUD 1,800–2,700/month

Suburb one-bedroom apartment: ~AUD 1,400–1,600/month

Three-bedroom apartment in suburbs: ~AUD 2,500–3,500/month

Rent is expected to continue rising slightly due to high demand.

3. How much should I budget for groceries and food?

Single person: AUD 400–700/month

Couple: AUD 700–1,000/month

Family of four: AUD 1,200–1,500/month

Dining out adds extra costs, especially in popular city restaurants and cafés.

4. What are typical utility costs in Sydney?

Monthly utility costs (electricity, water, gas) are around AUD 250–300, with internet adding AUD 70–90. Larger households or high energy use will increase these numbers.

5. How much does transportation cost in Sydney?

Public transport monthly pass: ~AUD 200–220

Owning a car: Additional costs for fuel, parking, insurance, and maintenance — can range AUD 300–500/month depending on usage

Public transport is generally more cost-effective than car ownership in the city.

6. Is Sydney affordable for families in 2026?

Sydney can be expensive for families, especially considering housing, childcare, schooling, and lifestyle costs. A family of four should budget at least AUD 5,800–6,500/month for a comfortable living standard. Outer suburbs or shared housing can help reduce expenses.

7. How does Sydney compare to other Australian cities in 2026?

Sydney is generally more expensive than Melbourne, Brisbane, Perth, and Adelaide, especially for rent and groceries. Living costs in Sydney are balanced by higher salaries and abundant job opportunities, but careful budgeting is crucial.

8. Can I live in Sydney on a student or minimum wage budget?

Living on a student or minimum wage budget is challenging in Sydney. Many students opt for shared apartments, outer suburbs, or part-time work to manage costs.

Monthly expenses for a frugal single student (including shared housing) may still reach AUD 2,000–2,500.